The amount you invoice the customer.

This affects cash flow and accounts receivable.

Billed Revenue Is Not Recognized Revenue — A Real Lesson from a Customer Project

Most subscription companies make one common mistake—treating billed revenue and recognized revenue as if they are the same. They’re not. And a recent project reminded us why this matters.

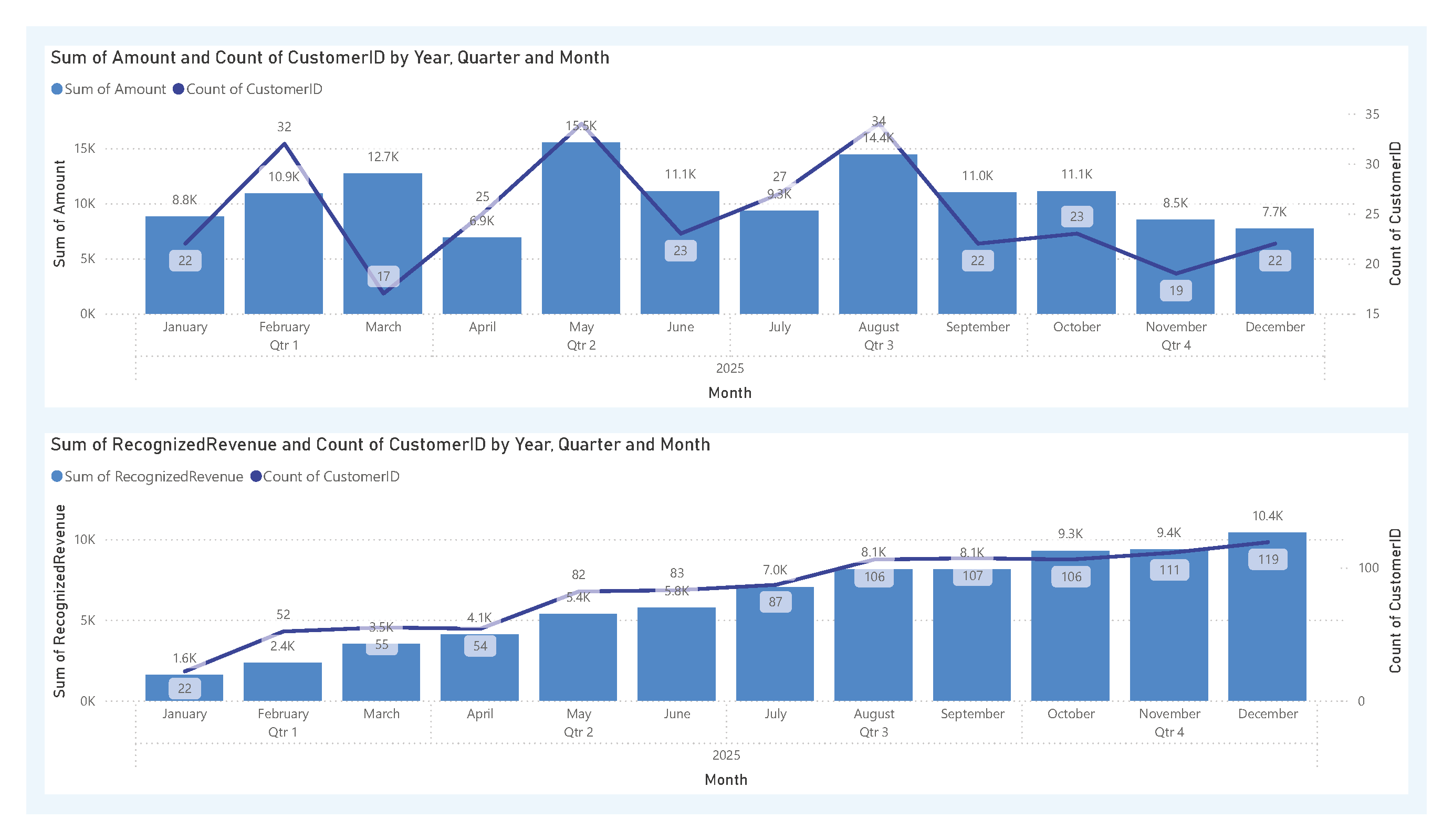

A client approached us asking for a finance dashboard to help them analyze revenue month-to-month, track growth, and forecast performance. But the moment we connected to their data, we noticed something strange: revenue spikes in random months, followed by quiet periods, even though customers were continuously subscribed.

The issue became obvious very quickly— they were recording revenue based on invoice date instead of service period.

This is one of the biggest pitfalls in subscription businesses.

Billed Revenue vs. Recognized Revenue

- Billed Revenue

- Recognized Revenue

The portion of revenue you actually earn as you deliver the service.

This affects your income statement and performance metrics.

For subscriptions—whether monthly or annual—revenue must be recognized over the duration of the service, not on the day the invoice is generated.

To help our client understand this more clearly, we walked them through two real-world scenarios.

Example 1: Annual Subscription Starting March 10

A customer subscribes to a 12-month prepaid plan on March 10 for $1,200.

What the client was doing (Incorrect)

They recognized all $1,200 in March.

Correct approach

The subscription covers 365 days, so revenue must be recognized daily.

Daily Rate: 1,200 ÷ 365 = $3.28767 per day

Below is the complete monthly recognition table:

Instead of one big spike in March, revenue is now smooth, accurate, and aligned with service delivery.

Example 2: Monthly Subscription Starting March 10

A customer subscribes to a month-to-month plan, billed $100 every month, starting March 10.

Service Period

March 10 → April 9 (31 days)

Daily Rate: 100 ÷ 31 = $3.225806 per day

Here is the complete recognition table:

Just like the annual plan, the monthly plan must be recognized based on days of service, not when the invoice is issued.

What This Meant for the Client

Once we corrected their revenue model:

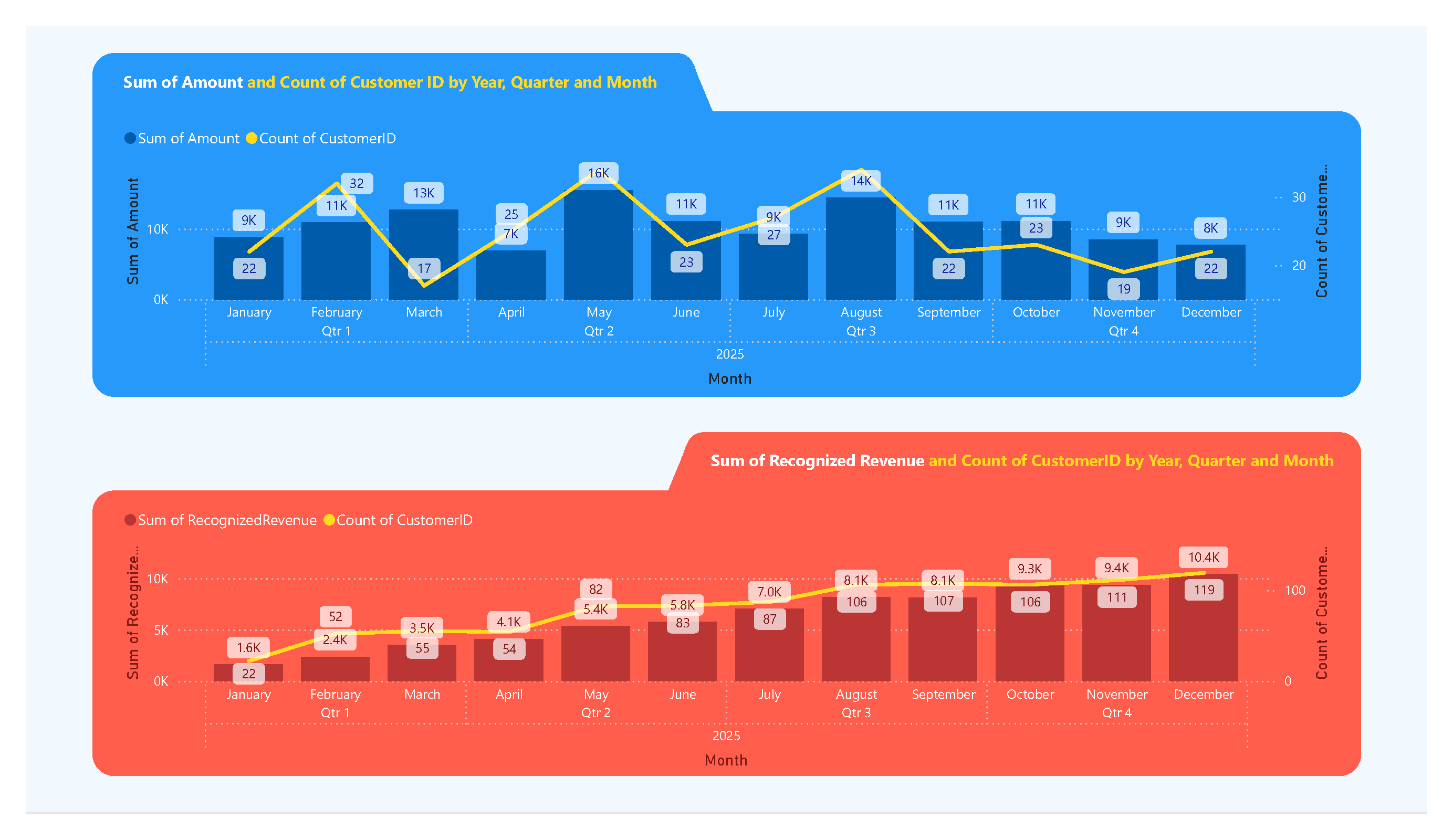

Their monthly revenue chart finally made sense: No more random spikes caused by annual invoices.

MRR and ARR became accurate: They could now show true recurring revenue to investors and accountants.

Forecasting became reliable: Because recognized revenue reflects real service periods—not billing habits.

Compliance improved: They now meet proper revenue recognition standards.

What started as a simple finance dashboard request turned into a major correction in how they recorded revenue. And ultimately, it brought clarity, accuracy, and trust to their financial reporting.

Before Correction

After Correction

Final Thoughts

Billed revenue tells you what the customer owes you.

Recognized revenue tells you what you actually earned.

Every subscription business—whether SaaS, membership, or services—must get this right. And as our client discovered, proper revenue recognition doesn’t just fix accounting; it transforms decision-making.